Sometimes it’s worth saying things again. The economy

changes, but economic principles don’t. So some of what I’ve written can be

said again and apply as well today.

I’ve posted a couple of collections of economic “best of”

posts:

Among these are some that I think are repeating in full. These two go together: “Parabolas,” from November 2011, and “The Trampoline Effect,” from March 2012. When we’re in the longest malaise (being

called a tepid recovery) since the Great Depression, maybe it’s worth reviewing

these.

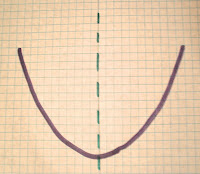

Parabolas

|

| Natural paraabolic shape of a recession and recovery |

With recessions, the rule is: what goes down

must come back up. The natural shape of a recession is a parabola. There’s a

sharp drop to as low as it’s going to go, and then the direction changes upward

during recovery. If it is allowed to follow the natural course of events, the

recovery will essentially mirror the drop—and then keep going up.

This is a concept my

sons, Economic Sphere and Political Sphere, have been sharing with me from time

to time. I don’t have the economic math skills to reproduce all the math logic

for you, unfortunately. But I think the basic concept will do. Recessions

happen because the market needs to correct, from a bubble or maybe a natural

disaster--something that interferes with the natural long-term aggregate growth

of the free market. But once there’s a drop, then a naturally growing market

returns.

Political Sphere

shared an article from Forbes about the concept

that recessions follow a natural course—unless interfered with. The article

makes that point that the excuse “this time is different” is never true.

|

| L-shaped recession, natural recovery is prevented |

Real trouble happens when there is interference, usually intended to “help.” According to Wikipedia, one of the shapes a recession can take is the L shape. In this one, the sharp drop happens just as you would expect. But then, instead of bouncing on the bottom and coming back up, the level just sort of dribbles along horizontally near the bottom. Other names for this are “depression,” “lost decade,” and “malaise.” These are all terms beginning to be applied to our current L-shaped recession. They are terms that applied to FDR’s Great Depression as well.

What is it that causes

this recession to be different, to languish at the bottom instead of bouncing

back? Government interference. How do we know?

This is maybe more

than you wanted, but here’s a basic formula:

Y = C + I + G +

NX

Y is GDP (production)

in actual dollars.

C is consumption,

which is a function of Y-T (taxes).

I is investment, or

infusion of new capital (not spending on used materials, or stock exchanges).

G is government

spending.

NX is net

exports.

Government can affect

Y by increasing spending or raising or lowering taxes. More taxes means less

money for consumers to spend, and less taxes means more money for consumers to

spend. Indirectly investment will be affected if Y decreases, when there is

less profit to be made. But mainly the other way government can change Y is by

increasing government spending.

I had to ask Economic

Sphere why the formula includes “+G” instead of “-G.” In theory, G is just

another product consumers (we the people) spend money on. To some degree it’s

necessary. So the amount spent on G is just another part of the measure of GDP.

However, when spending on government is too high—includes debt—it temporarily

appears that the G portion of the economy shows actual growth in GDP. But that

is an illusion.

|

| natural ups and downs of business cycle show a sine wave |

It appears, in the

short run, that government spending (or stimulus) increases Y. But Y’s rate of

growth is, in a natural free market, fairly constant. There is fluctuation, an

ongoing sine wave, or little rises and dips, but you can draw a line through that

at approximately the natural rate of growth (maybe somewhere near 4%).

Government spending can’t change that. It doesn’t affect aggregate supply; it

only affects aggregate demand. So it may appear for a time that it has affected

growth, but there will be a natural pull back to the equilibrium point where

aggregate supply and demand intersect. There will be a correction. So the more

government does to try to make the market go up, the greater will be the

eventual correction back to the natural rate of growth.

The longer and greater

the government over-expenditures, the more drastic will be the inevitable

correction.

So what happens if

government sees that inevitable drop and tries to prevent it—with more

government spending? It causes an even greater drop. If the measures are taken

after the drop, presumably in an effort to stop more drop or cause a rise, it

interferes with the natural recovery. That is what we’re seeing now.

Greater government

spending at a time when great government spending already caused the dip is

like hitting the economy over the head and beating it down. Every new

interference, every new beat down, leaves the economy languishing down at the

bottom, unable to rise because of the repeated drop-causing interferences. When

they say, “The economy was in much worse shape than we thought; imagine how bad

a shape we’d be in if we had done nothing,” you can know for certain that

things are worse because of what they did in their ignorant attempts to control

a natural force.

If government wants to

have a positive effect on GNP, it needs to cut spending. Since it can’t (won’t)

cut to zero, the next best thing would be to cut to the bare bones of the

enumerated powers of the Constitution. At the same time, lowering rather than

raising taxes will help. Both lowered government spending and lowered taxes

leave more money available for growth.

The Trampoline Effect

The other night I was reading something about

the recovering economy—a recovery so tepid we can’t perceive it; instead we

must take government’s word for it. Never comforting. And the reading led me to

talk with my son Political Sphere about the concept that, the deeper the

recession, the stronger the following recovery. I wrote about this principle

with more detail in “Parabolas” on November 21st.

So, we were discussing this concept, and

Political Sphere unveiled what he calls the Trampoline Effect. On a trampoline,

the harder you come down (from a higher or heavier fall), the higher and more

powerful the bounce back up. But if a big brother (yes, he worded it that way,

with plenty of extra meanings) steps in to “help,” it doesn’t help. It usually

disturbs the bounce, taking the energy out of it, and you end up with buckled

knees and a few small bounces fading into flatness.

|

| photo from trampoline.com |

Picture the difference between a parabola (the

natural down and back up bounce) and what is euphemistically referred to as an

L-shaped recovery, but is really just the dribble that happens from

interference in the bounce.

Big Brother “helping” is the government

stepping in, taking actions that interfere with the energy of the natural

growing economy.

So, every time you hear someone say, “We had

to do something,” or “Think how bad it would be if we hadn’t taken

action,” translate that in your mind to the Trampoline Effect. Does the jumper

need you to step in and “help” in order to bounce back up? No, that is going to

happen unless you interfere.

A recovery, by definition, is coming back up

to at least the starting point. If that hasn’t happened, we’re either still

going down, or we’re stuck down flat because of the interference. What we need

is for Big Brother to get out of the way so we can make a few small tentative

bounces and put our energy into building up a good parabolic rise. But every

time he steps in, he zaps the energy out of your bounce and leaves you

flagging.

Y = C + I + G + NX is a static model and only deals with one time period. What's more important over time is the change in Y (dY). If we change the function for the change then dY is a function of I(s,r(s)) where s is savings and r is the real interest rate. Government expenditures artificially raise the real interest rate by taking from savings either through government debt (treasury bonds), or decreasing incomes through taxes.

ReplyDeleteSomeone may notice that I assume that government spending is not also investment, and you're right, but other than infrastructure spending you'll have a hard time showing any sort of GDP growth. Now for the infrastructure spending we look to stimulus data from previous government responses to recessions and come up with an estimated return of about -33%, which is pretty abysmal.

All of this can be summed up with one simple sentence. Less government spending means faster economic growth. Or, less government, more jobs/wealth/goods produced.

P.S. Another takeaway is that savings drives investment, not consumption.